To celebrate the publication of Proof of Stake: The Making of Ethereum and the Philosophy of Blockchains by Vitalik Buterin, edited by Nathan Schneider, we are proud to share an excerpt from the book, a blog post originally published in 2021, in which Buterin outlines his vision for how cryptocurrency and the blockchain can be used for the betterment of civic life.

CRYPTO CITIES

vitalik.ca

October 31, 2021

One interesting trend of the last year has been the growth of interest in local government, and in the idea of local governments that have wider variance and do more experimentation. Over the past year, Miami mayor Francis Suarez has pursued a tech-startup-like strategy of attracting interest in the city, frequently engaging with the mainstream tech industry and crypto community on Twitter. Wyoming now has a DAO-friendly legal structure, Colorado is experimenting with quadratic voting, and we’re seeing more and more experiments making pedestrian-friendly street environments for the offline world. We’re even seeing projects with varying degrees of radicalness—Culdesac, Telosa, CityDAO, Nkwashi, Prospera, and many more—trying to create entire neighborhoods and cities from scratch.

Another interesting trend of the last year has been the rapid mainstreaming of crypto ideas such as coins, non-fungible tokens, and decentralized autonomous organizations (DAOs). So what would happen if we combine the two trends together? Does it make sense to have a city with a coin, an NFT, a DAO, some record-keeping on-chain for anti-corruption, or even all four? As it turns out, there are already people trying to do just that:

CityCoins.co, a project that sets up coins intended to become local media of exchange, where a portion of the issuance of the coin goes to the city government. MiamiCoin already exists, and San Francisco Coin appears to be coming soon.

Experiments with NFTs, often as a way of funding local artists. Busan is hosting a government-backed conference exploring what they could do with NFTs.

Reno mayor Hillary Schieve’s expansive vision for blockchain-ifying the city, including NFT sales to support local art, a RenoDAO with RenoCoins issued to local residents that could get revenue from the government renting out properties, blockchain-secured lotteries, blockchain voting, and more.

Much more ambitious projects creating crypto-oriented cities from scratch: see CityDAO, which describes itself as, well, “building a city on the Ethereum blockchain”—DAOified governance and all.

But are these projects, in their current form, good ideas? Are there any changes that could make them into better ideas? Let us find out . . .

WHY SHOULD WE CARE ABOUT CITIES?

Many national governments around the world are showing themselves to be inefficient and slow-moving in response to long-running problems and rapid changes in people’s underlying needs. In short, many national governments are missing live players. Even worse, many of the outside-the-box political ideas that are being considered or implemented for national governance today are honestly quite terrifying. Do you want the USA to be taken over by a clone of the World War II-era Portuguese dictator António Salazar, or perhaps an “American Caesar,” to beat down the evil scourge of American leftism? For every idea that can be reasonably described as freedom-expanding or democratic, there are ten that are just different forms of centralized control and walls and universal surveillance.

Now consider local governments. Cities and states, as we’ve seen from the examples at the start of this post, are, at least in theory, capable of genuine dynamism. There are large and very real differences of culture between cities, so it’s easier to find a single city where there is public interest in adopting any particular radical idea than it is to convince an entire country to accept it. There are very real challenges and opportunities in local public goods, urban planning, transportation, and many other sectors in the governance of cities that could be addressed. Cities have tightly cohesive internal economies where things like widespread cryptocurrency adoption could realistically independently happen. Furthermore, it’s less likely that experiments within cities will lead to terrible outcomes both because cities are regulated by higher-level governments and because cities have an escape valve: people who are unhappy with what’s going on can more easily exit.

So all in all, it seems like the local level of government is a very undervalued one. And given that criticism of existing smart-city initiatives often heavily focuses on concerns around centralized governance, lack of transparency, and data privacy, blockchain and cryptographic technologies seem like a promising key ingredient for a more open and participatory way forward.

WHAT ARE CITY PROJECTS UP TO TODAY?

Quite a lot actually! Each of these experiments is still small scale and largely still trying to find its way around, but they are all at least seeds that could turn into interesting things. Many of the most advanced projects are in the United States, but there is interest across the world; over in Korea the government of Busan is running an NFT conference. Here are a few examples of what is being done today.

BLOCKCHAIN EXPERIMENTS IN RENO

Reno, Nevada, mayor Hillary Schieve is a blockchain fan, focusing primarily on the Tezos ecosystem, and she has recently been exploring blockchain-related ideas in the governance of her city:

Selling NFTs to fund local art, starting with an NFT of the “Space Whale” sculpture in the middle of the city.

Creating a RenoDAO, governed by Reno coins that residents would be eligible to receive via an airdrop. The RenoDAO could start to get sources of revenue; one proposed idea was for the city to rent out properties that it owns and use the revenue to fund a DAO.

Using blockchains to secure all kinds of processes; for example, blockchain-secured random number generators for casinos, blockchain-secured voting, etc.

CITYCOINS.CO

CityCoins.co is a project built on Stacks, a blockchain run by an unusual “proof of transfer” (for some reason abbreviated PoX, not PoT) block-production algorithm that is built around the Bitcoin blockchain and ecosystem. Seventy percent of the coin’s supply is generated by an ongoing sale mechanism: anyone with STX (the Stacks native token) can send their STX to the city-coin contract to generate city coins; the STX revenues are distributed to existing city-coin holders who stake their coins. The remaining 30% is made available to the city government.

CityCoins has made the interesting decision of trying to make an economic model that does not depend on any government support. The local government does not need to be involved in creating a CityCoins.co coin; a community group can launch a coin by themselves. An FAQ-provided answer to “What can I do with CityCoins?” includes examples like “CityCoins communities will create apps that use tokens for rewards” and “local businesses can provide discounts or benefits to people who . . . stack their CityCoins.” In practice, however, the MiamiCoin community is not going at it alone; the Miami government has already de facto publicly endorsed it.

MiamiCoin hackathon winner: a site that allows coworking spaces to give preferential offers to MiamiCoin holders.

CITYDAO

CityDAO is the most radical of the experiments: Unlike Miami and Reno, which are existing cities with existing infrastructure to be upgraded and people to be convinced, CityDAO is a DAO with legal status under the Wyoming DAO law trying to create entirely new cities from scratch.

So far, the project is still in its early stages. The team is currently finalizing a purchase of their first plot of land in a far-off corner of Wyoming. The plan is to start with this plot of land, and then add other plots of land in the future, to build cities that are governed by a DAO and make heavy use of radical economic ideas like Harberger taxes to allocate the land, make collective decisions, and manage resources. Their DAO is one of the progressive few that is avoiding coin-voting governance; instead, the governance is a voting scheme based on “citizen” NFTs, and ideas have been floated to further limit votes to one per person by using Proof of Humanity verification. The NFTs are currently being sold to crowdfund the project; you can buy them on OpenSea.

WHAT DO I THINK CITIES COULD BE UP TO?

Obviously there are a lot of things that cities could do in principle. They could add more bike lanes, they could use CO2 meters and far-UVC light to more effectively reduce COVID spread without inconveniencing people, and they could even fund life-extension research. But my primary specialty is blockchains and this post is about blockchains, so . . . let’s focus on blockchains.

I would argue that there are two distinct categories of blockchain ideas that make sense:

1. Using blockchains to create more trusted, transparent, and verifiable versions of existing processes.

2. Using blockchains to implement new and experimental forms of ownership for land and other scarce assets, as well as new and experimental forms of democratic governance.

There’s a natural fit between blockchains and both of these categories. Anything happening on a blockchain is very easy to publicly verify, with lots of ready-made, freely available tools to help people do that. Any application built on a blockchain can immediately plug in to and interface with other applications in the entire global blockchain ecosystem. Blockchain-based systems are efficient in a way that paper is not, and publicly verifiable in a way that centralized computing systems are not—a necessary combination if you want to, say, make a new form of voting that allows citizens to give high-volume real-time feedback on hundreds or thousands of different issues.

So let’s get into the specifics.

WHAT ARE SOME EXISTING PROCESSES THAT BLOCKCHAINS COULD MAKE MORE TRUSTED AND TRANSPARENT?

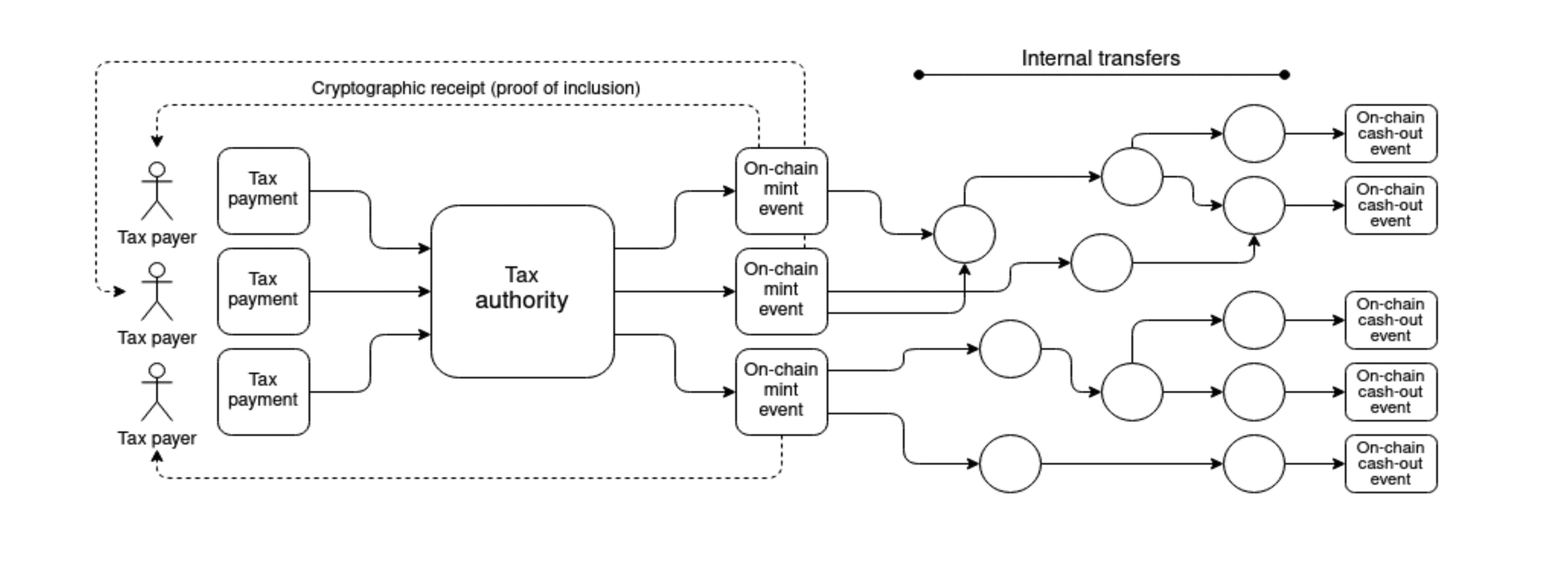

One simple idea that plenty of people, including government officials around the world, have brought up to me on many occasions is the idea of governments creating a white-listed internal-use-only stablecoin for tracking internal government payments. Every tax payment from an individual or organization could be tied to a publicly visible on-chain record minting that number of coins (if we want individual tax payment quantities to be private, there are zero-knowledge ways to make only the total public but still convince everyone that it was computed correctly). Transfers between departments could be done “in the clear,” and the coins would be redeemed only by individual contractors or employees claiming their payments and salaries.

This system could easily be extended. For example, procurement processes for choosing which bidder wins a government contract could largely be done on-chain.

Many more processes could be made more trustworthy with blockchains:

FAIR RANDOM NUMBER GENERATORS (E.G., FOR LOTTERIES)—VDFs, such as the one Ethereum is expected to include, could serve as a fair random number generator that could be used to make government-run lotteries more trustworthy. Fair randomness could also be used for many other use cases, such as sortition as a form of government.

CERTIFICATES—for example, cryptographic proofs that some particular individual is a resident of the city—could be done on-chain for added verifiability and security (e.g., if such certificates are issued on-chain, it would become obvious if a large number of false certificates are issued). This can be used by all kinds of local-government-issued certificates.

ASSET REGISTRIES, for land and other assets, as well as more complicated forms of property ownership such as development rights. Due to the need for courts to be able to make assignments in exceptional situations, these registries will likely never be fully decentralized bearer instruments in the same way that cryptocurrencies are, but putting records on-chain can still make it easier to see what happened in what order in a dispute.

Eventually, even voting could be done on-chain. Here, many complexities and dragons loom, and it’s really important to be careful; a sophisticated solution combining blockchains,

zero-knowledge proofs, and other cryptography is needed to achieve all the desired privacy and security properties. However, if humanity is ever going to move to electronic voting at all, local government seems like the perfect place to start.

WHAT ARE SOME RADICAL ECONOMIC AND GOVERNANCE EXPERIMENTS THAT COULD BE INTERESTING?

But in addition to these kinds of blockchain overlays onto things that governments already do, we can also look at blockchains as an opportunity for governments to make completely new and radical experiments in economics and governance. These are not necessarily final ideas on what I think should be done; they are initial explorations and suggestions for possible directions. Once an experiment starts, real-world feedback is often by far the most useful variable to determine how the experiment should be adjusted in the future.

EXPERIMENT #1: A MORE COMPREHENSIVE VISION OF CITY TOKENS

CityCoins.co is one vision for how city tokens could work. But it is far from the only vision. Indeed, the CityCoins.co approach has significant risks, particularly in how the economic model is heavily tilted toward early adopters. Seventy percent of the STX revenue from minting new coins is given to existing stakers of the city coin. More coins will be issued in the next five years than in the fifty years that follow. It’s a good deal for the government in 2021, but what about 2051? Once a government endorses a particular city coin, it becomes difficult for it to change directions in the future. Hence, it’s important for city governments to think carefully about these issues, and choose a path that makes sense for the long term.

Here is a different possible sketch of a narrative of how city tokens might work. It’s far from the only possible alternative to the CityCoins.co vision. In any case, city tokens are a wide design space, and there are many different options worth considering. Anyway, here goes . . .

The concept of home ownership in its current form is a notable double-edged sword, and the specific ways in which it’s actively encouraged and legally structured is considered by many to be one of the biggest economic policy mistakes that we are making today. There is an inevitable political tension between a home as a place to live and a home as an investment asset, and the pressure to satisfy communities who care about the latter often ends up severely harming the affordability of the former. Residents in a city either own a home, making them massively over-exposed to land prices and introducing perverse incentives to fight against construction of new homes, or rent a home, making them negatively exposed to the real estate market and thus putting them economically at odds with the goal of making a city a nice place to live.

But even despite all of these problems, many still find home ownership to be not just a good personal choice, but something worthy of actively subsidizing or socially encouraging. One big reason is that it nudges people to save money and build up their net worth. Another big reason is that despite its flaws, it creates economic alignment between residents and the communities they live in. But what if we could give people a way to save and create that economic alignment without the flaws? What if we could create a divisible and fungible city token, that residents could hold as many units of as they can afford or feel comfortable with, and whose value goes up as the city prospers?

First, let’s start with some possible objectives. Not all are necessary; a token that accomplishes only three of the five is already a big step forward. But we’ll try to hit as many of them as possible:

GET SUSTAINABLE SOURCES OF REVENUE FOR THE GOVERNMENT: The city token economic model should avoid redirecting existing tax revenue; instead, it should find new sources of revenue.

CREATE ECONOMIC ALIGNMENT BETWEEN RESIDENTS AND THE CITY: This means first of all that the coin itself should clearly become more valuable as the city becomes more attractive. But it also means that the economics should actively encourage residents to hold the coin more than faraway hedge funds.

PROMOTE SAVING AND WEALTH-BUILDING: Home ownership does this—as home owners make mortgage payments, they build up their net worth by default. City tokens could do this too, making it attractive to accumulate coins over time, and even gamifying the experience.

ENCOURAGE MORE PRO-SOCIAL ACTIVITY: Such as positive actions that help the city and more sustainable use of resources.

BE EGALITARIAN: Don’t unduly favor wealthy people over poor people (as badly designed economic mechanisms often do accidentally). A token’s divisibility, avoiding a sharp binary divide between haves and have-nots, does a lot already, but we can go further—for example, by allocating a large portion of new issuance to residents as a UBI.*

*Universal basic income, in which all residents would receive an equal, unconditional income at regular intervals.

One pattern that seems to easily meet the first three objectives is providing benefits to holders: If you hold at least x coins (where x can go up over time), you get some set of services for free. MiamiCoin is trying to encourage businesses to do this, but we could go further and make government services work this way too. One simple example would be making existing public parking spaces only available for free to those who hold at least some number of coins in a locked-up form. This would serve a few goals at the same time:

Create an incentive to hold the coin, sustaining its value.

Create an incentive specifically for residents to hold the coin, as opposed to otherwise-unaligned faraway investors. Furthermore, the incentive’s usefulness is capped per person, so it encourages widely distributed holdings.

Creates economic alignment (city becomes more attractive —> more people want to park —> coins have more value). Unlike home ownership, this creates alignment with an entire town, and not merely a very specific location in a town.

Encourage sustainable use of resources by reducing usage of parking spots (though people without coins who really need them could still pay), supporting many local governments’ desires to open up more pedestrian-friendly space on the roads. Alternatively, restaurants could also be allowed to lock up coins through the same mechanism and claim parking spaces to use for outdoor seating.

But to avoid perverse incentives, it’s extremely important to avoid overly depending on one specific idea and instead to have a diverse array of possible revenue sources. One excellent gold mine of places to give city tokens value, and at the same time experiment with novel governance ideas, is zoning. If you hold at least y coins, then you can quadratically vote on the fee that nearby landowners have to pay to bypass zoning restrictions. This hybrid market- plus direct-democracy-based approach would be much more efficient than current overly cumbersome permitting processes, and the fee itself would be another source of government revenue. More generally, any of the ideas in the next section could be combined with city tokens to give city-token holders more places to use them.

EXPERIMENT #2: MORE RADICAL AND PARTICIPATORY FORMS OF GOVERNANCE

This is where Radical Markets* ideas such as Harberger taxes, quadratic voting, and quadratic funding come in. I already brought up some of these ideas in the section above, but you don’t have to have a dedicated city token to do them. Some limited government use of quadratic voting and funding has already happened: see the Colorado Democratic Party and the Taiwanese presidential hackathon, as well as not-yet-government-backed experiments like Gitcoin’s Boulder Downtown Stimulus. But we could do more!

*Again, referencing the book of this name (and its family of concepts) by Eric Posner and E. Glen Weyl.

One obvious place where these ideas can have long-term value is giving developers incentives to improve the aesthetics of buildings. Harberger taxes and other mechanisms could be used to radically reform zoning rules, and blockchains could be used to administer such mechanisms in a more trustworthy and efficient way. Another idea that is more viable in the short term is subsidizing local businesses, similar to the Downtown Stimulus but on a larger and more permanent scale. Businesses produce various kinds of positive externalities in their local communities all the time, and those externalities could be more effectively rewarded. Local news could be quadratically funded, revitalizing a long-struggling industry. Pricing for advertisements could be set based on real-time votes of how much people enjoy looking at each particular ad, encouraging more originality and creativity.

More democratic feedback (and possibly even retroactive democratic feedback!) could plausibly create better incentives in all of these areas. And twenty-first-century digital democracy through real-time online quadratic voting and funding could plausibly do a much better job than twentieth-century democracy, which seems in practice to have been largely characterized by rigid building codes and obstruction at planning and permitting hearings. And of course, if you’re going to use blockchains to secure voting, starting off by doing it with fancy new kinds of votes seems far more safe and politically feasible than re-fitting existing voting systems.

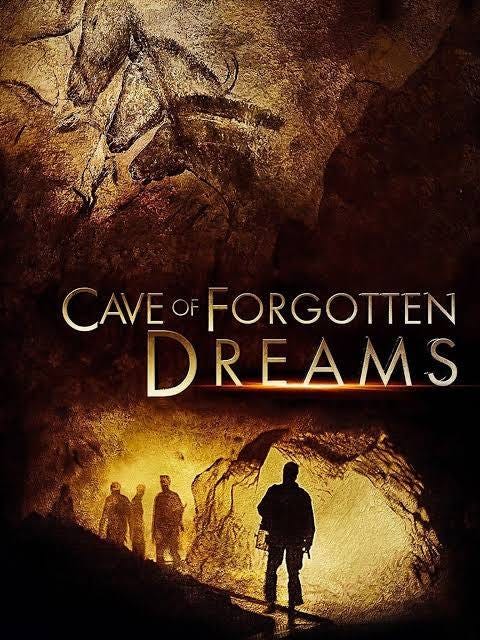

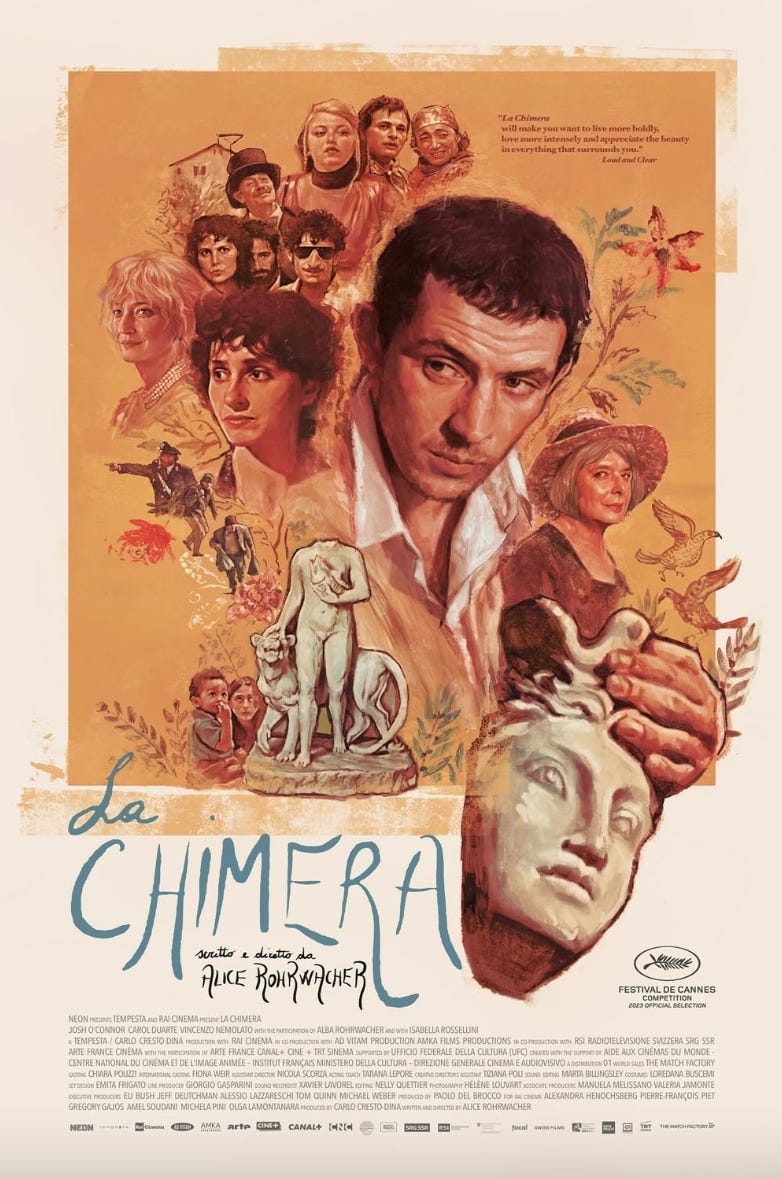

Mandatory solarpunk picture intended to evoke a positive image of what might happen to our cities if real-time quadratic votes could set subsidies and prices for everything.

from

from